Take payments anywhere — from the shop floor to the counter, from tableside to curbside. Our included* smart wireless payment solutions let you accept payments wherever customers are, without being tied to a register or fixed checkout.

Included on the Smart Terminal Duo and Flex.

Dough empowers your business with industry-leading features, all included at no additional cost.

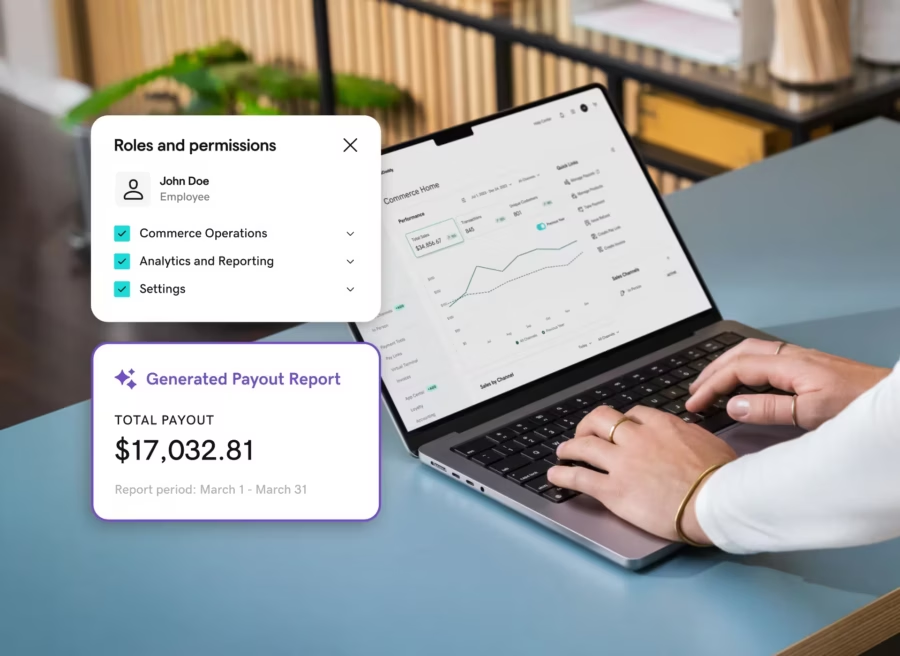

Manage your inventory, customers, orders, employees, accounting, and more from a central hub. Get real-time 360° reporting and manage your teams with specific roles and accesses.

Choose a handheld POS that can be used anywhere or choose the dual screen POS for Countertop sales.

Commerce Sync automatically reconciles your daily transactions, fees, and payouts—so your deposits always match your reporting.

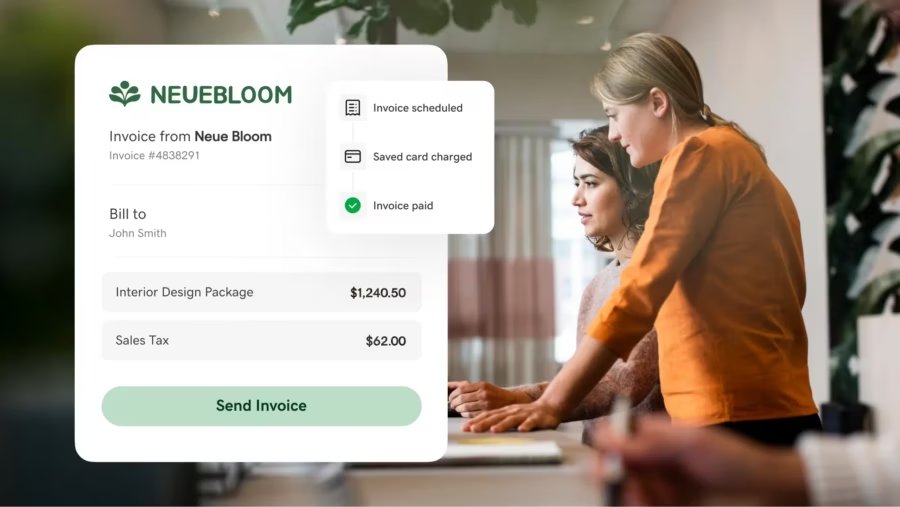

Create and send professionally branded invoices wherever you do business. Send single invoices, or setup a recurring series of invoices to collect payment automatically.

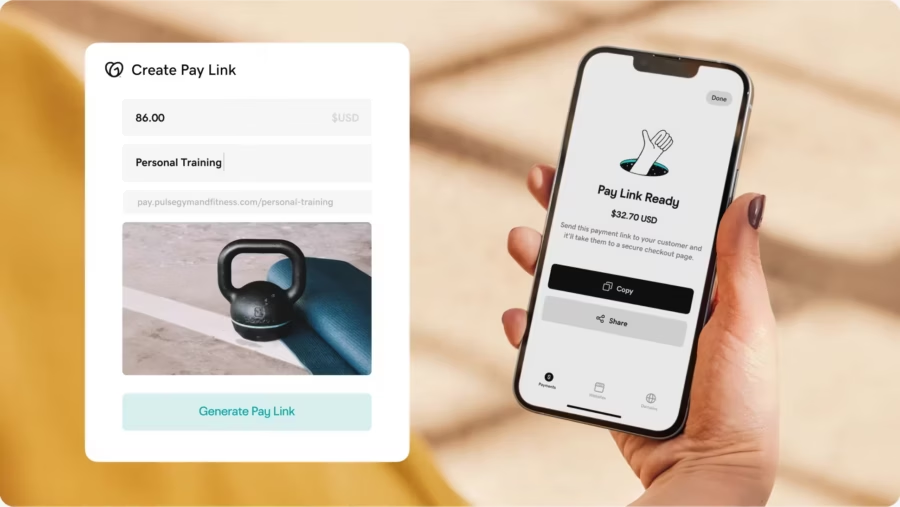

Create a shareable payment link, the easy way to accept payments. Look professional with an image, logo, and info on your payment link.

Manually enter card payments from your smartphone, computer, or any wifi-connected device to quickly accept remote payments.

Failure to comply with surcharging rules may result in card-network fines, required refunds, or other enforcement actions. Practices should ensure they fully understand all applicable requirements before applying a surcharge.

Most major credit card networks permit surcharging when done in accordance with their rules, but additional requirements or restrictions may apply. Practices should ensure they have completed all required network notifications and disclosures prior to enabling surcharging.

No. While Dough provides tools and general guidance to support credit card surcharging, compliance with all applicable laws and card-network rules is the responsibility of the merchant. Dough does not provide legal advice and assumes no liability for a merchant’s compliance.

Yes. Some U.S. states and territories prohibit or restrict credit card surcharging. Practices are responsible for understanding and complying with their state’s specific requirements before implementing a surcharge.

Yes. Card networks require clear and transparent disclosure of any credit card surcharge. Practices must notify patients through appropriate signage at the practice entrance, point of sale, and anywhere payments are accepted. If payments are accepted online, the surcharge must also be clearly disclosed on the practice’s website.

Yes. Credit card surcharges may not exceed the merchant’s actual cost of accepting credit cards and are capped at a maximum of 3% of the total transaction amount, in accordance with card-network rules and applicable law.

No. Debit card transactions may not be surcharged under any circumstances, even if the debit card is processed as a credit transaction or entered manually.

A credit card surcharge is an additional fee added to a transaction when a patient chooses to pay with a credit card. The surcharge is intended to help offset the cost of credit card processing and applies only to eligible credit card transactions.

If you are considering introducing a credit card surcharge for your customers, it is important to understand that there are specific rules and regulations that must be followed when enrolling in and operating under a surcharge plan.

This article provides a general overview of common surcharging requirements. This content is provided for informational purposes only and does not constitute legal advice. It is the responsibility of each merchant to review, understand, and comply with all applicable laws, card-network rules, and regulatory requirements, including notification timeframes, signage requirements, surcharge percentage limits, and jurisdictions where surcharging is prohibited.

If you are unsure about the laws or regulations applicable to your business, you should consult with qualified legal counsel. Dough assumes no liability for a merchant’s compliance or non-compliance with credit card surcharging rules or regulations.

Transparent Communication

card surcharge is applied.

Businesses must clearly notify customers of a credit card surcharge through appropriate signage placed at the business entrance, at the point of sale or terminal, and anywhere payments are accepted. If payments are accepted online, surcharge disclosures must also be clearly visible on the business’s website. All disclosures must inform customers that the surcharge applies only to credit card transactions.

Surcharge Limits

Credit card surcharges must comply with both card-network rules and applicable law. The surcharge amount may not exceed the merchant’s actual cost of accepting credit cards and may not exceed 3% of the total transaction amount.

Card-network rules cap credit card surcharges at 3%, meaning that if a merchant’s processing costs exceed this amount, the excess portion cannot be passed on to the customer.

Network and State Restrictions

The major credit card networks, such as Visa and Mastercard, impose specific requirements related to surcharge limits, advance notification, and disclosure.

In addition, several U.S. states and territories regulate or prohibit credit card surcharging. At the time of writing, credit card surcharging is prohibited in Connecticut, Maine, Massachusetts, and Puerto Rico. Other states, including Colorado, Minnesota, Mississippi, New Jersey, and New York, impose restrictions on surcharge amounts or require specific disclosures.

If your business operates in a state that restricts or prohibits credit card surcharging, you must fully understand and comply with those requirements before implementing a surcharge.

Debit card transactions may never be surcharged, even if the debit card is processed as a credit transaction.

Applicability

Credit card surcharges may be applied only to credit card transactions. Other payment types, including debit cards and alternative payment methods, are not eligible for surcharging.

Regulatory Compliance

Merchants are responsible for maintaining ongoing compliance with all applicable card-network and legal requirements. This includes meeting advance notification obligations, using compliant signage and disclosures, adhering to surcharge percentage limits, and respecting jurisdiction-specific restrictions.

By following these guidelines, businesses can implement credit card surcharging in a way that aligns with card-network rules and promotes transparency with customers. Clear and upfront communication helps maintain customer trust and supports a positive payment experience.

Zero processing cost—customers cover the card fee.